Study shows tax would hurt economy

By Staff

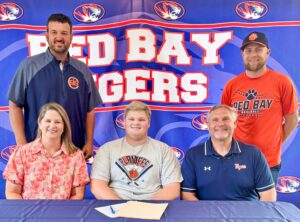

Jonathan Willis

Less than 12 hours after the Franklin County Commission passed a one-cent sales tax increase, an economist from the University of North Alabama told Russellville city council members Monday that a tax increase would hurt the local economy.

The city council has been looking at adding a penny increase for more than two months, but has been deadlocked 3-3 on the issue.

Councilman David Grissom, who has repeatedly voted against an increase, asked the Center for Public Policy and Economic Research at the University of North Alabama to conduct an economic impact study on the issue.

The city has not yet passed an operating budget and has estimated that a one-cent sales tax increase would generate about $1.2 million.

But UNA economics professor Dr. Jim Couch painted a different picture.

"It will change your tax base," Couch said. "Cross jurisdictional shopping is very easy for you so I would expect more shoppers to go to Muscle Shoals and Florence and the surrounding areas. If you raise the price, quantity and demand fall."

If consumers reacted mildly to the one-cent sales tax, Couch predicted the Russellville economy would shrink by $5.7 million, the city would lose $277,000 in predicted tax revenue, total income of Russellville residents would fall $7.6 million and the private sector would lose 128 jobs.

If shoppers reacted more strongly and decided to shop outside of Russellville, the study predicted the city's economy would shrink nearly 10 percent, the additional sales tax revenue would miss its mark by $508,000, total income of Russellville residents would fall $16.8 million and the private sector would lose 283 jobs.

The center used data provided from studies in West Virginia and Wisconsin.

Councilman Jeff Masterson said he didn't believe that shoppers would travel to areas that already have a higher sales tax than Russellville.

Mayor Troy Oliver said the city sees about $120 million in taxable sales each year, with the largest portion of that spent at the Wal-Mart Supercenter.

The council's agenda did not include voting on the one-cent increase Monday like it was on the previous two.

The results of the study are based on current sales tax numbers staying at their current levels.

"This is not exact, but do I believe there will be a negative impact," Couch asked. "Yes, I do."